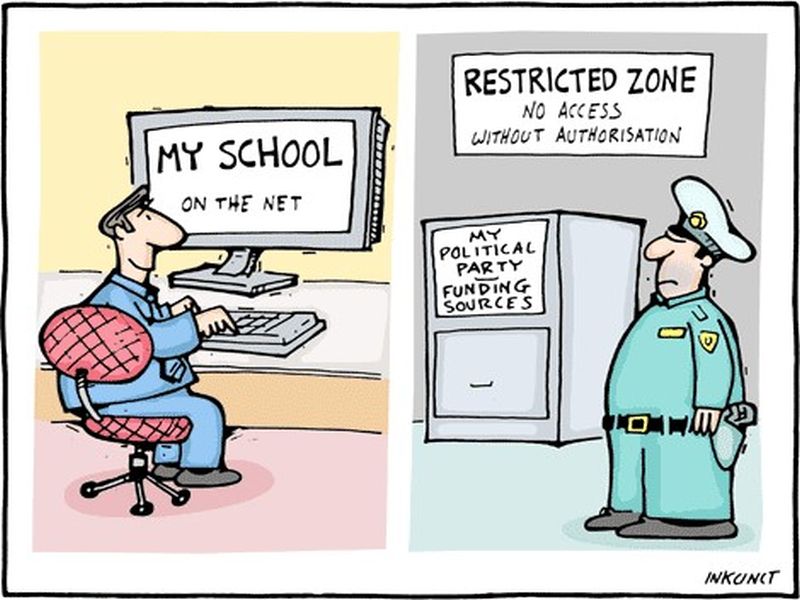

Transparent political party funding through Electoral Bonds: Government of India proposes, State Bank of India disposes- an RTI tale

Image courtesy: https://www.

June 28, 2018

By Venkatesh Nayak

Time and again, the Government of India has publicly said that donations to political parties made through Electoral Bonds (EBs) will increase transparency of political party funding. The Hon'ble Union Finance Minister said so in his February 2017 Budget speech while introducing the statutory mechanism for EBs (see paras # 164-165 of his speech). In January this year, he repeated this assertion in the Lok Sabha. A week later, on a FaceBook post, he gave his take on how EBs would make political funding more transparent than the practice that prevailed hitherto. So far so good.

The State Bank of India (SBI) - the only Bank authorised by the Government to sell EBs publicly- has refused to divulge the identity and other details of buyers under The Right to Information Act, 2005 (RTI Act). So much for the guarantee of transparency of political party funding through EBs.

The RTI Intervention

The Union Finance Ministry notified the Electoral Bonds Scheme on 02 January, 2018. EBs have been sold through various SBI branches in three phases - in March, April and May, this year. After waiting for the first two sale windows to close (the sale is open for barely a week each time and the EBs are themselves valid only for 15 days after purchase), I submitted the following queries to SBI under the RTI Act:

"Apropos of the Government of India notifying your Bank as the “Authorised Bank” for the purpose of sale and encashment of Electoral Bonds Scheme, 2018, I would like to obtain the following information about the same under the RTI Act:

(i) The denomination-wise total number of electoral bonds sold by each of your authorised branches in March and April 2018 along with the total number of buyers of each denomination;

(ii)The total number of buyers of electoral bonds in each category, namely, individuals, HUF, Company, Firm, Charitable Trust and Others who purchased electoral bonds from each of your authorised branches in March and April 2018;

(iii) A clear photocopy of all application forms received by your authorised branches against which electoral bonds were sold in March and April, 2018;

(iv) A clear photocopy of all redemption slips received and accepted by your authorised branches from every political party in relation to electoral bonds till date;

(v) The methodology applied by your Bank to ascertain whether or not a political party redeeming electoral bonds with any of your authorised branches had secured at least 1% of the votes polled during the last round of general elections to Parliament or the State Legislatures, till date;

(vi) A clear photocopy of all Declarations of Beneficial Ownership received from companies purchasing electoral Bonds in March and April, 2018.

(vii) A clear photocopy of all returns or reports, by whatever name called, submitted by your Bank to the Government of India regarding the sale and encashment of electoral bonds till date; and

(viii) A clear photocopy of all returns or reports, by whatever name called, submitted by your Bank to the Reserve Bank of India regarding the sale and encashment of electoral bonds till date."

Within two weeks of receiving the RTI application, the SBI rejected access to information on six out of the eight queries (the RTI application and the reply are in the 1st attachment).

SBI's Central Public Information Officer (CPIO) provided data on the first query, i.e., denomination and branch-wise sale of EBs. A preliminary analysis of the sale-data provided by SBI is given below (the datasheet is in the 2nd attachment):

I. First phase of EB sale in March 2018:

1) 520 EBs of various denominations were sold through SBI's designated branches in the four metros of New Delhi, Chennai, Mumbai and Kolkata. The Kolkata branch sold the most number of EBs (212 nos.), followed by the Mumbai branch (186 nos.), the New Delhi branch (63 nos.) and the Chennai branch (59 nos.).

2) A little more than Rs. 222 crores (INR 2.2 billion) worth of EBs were sold during the first phase of the sale. There were more takers for EBs of Rs. 10 lakh (INR 1 million) denomination than other denominations.

3) Mumbai branch of SBI sold more EBs of Rs. 1 crore (INR 10 million) i.e., 152 nos. among the 4 metro branches.

4) Only 10 EBs of Rs, 1,000 denomination were sold during this period. Six were sold through the Chennai branch. This indicates that EBs are not the preferred mode for small scale donors such as individuals.

5) SBI's Kolkata branch sold the most number of EBs of Rs. 10 lakh (INR 1 million) denomination (200 nos.) followed by Mumbai (70 nos.), Chennai (40 nos.) and New Delhi (10 nos.).

6) There were no buyers for the Rs. 1 lakh (INR 100,000) denomination during this phase.

II. Second phase of EB sale in April 2018:

1) During the 2nd phase, only 256 EBs were sold through the Gandhinagar branch of SBI in Gujarat and those in the 4 metros of New Delhi, Mumbai, Chennai and Kolkata. Again, Kolkata topped the list with 132 nos. of EBs sold during this phase, followed by Gandhinagar (57 nos.), Mumbai (51 nos.), New Delhi (13 nos.) and Chennai (3 nos.).

2) Only Rs. 101 crores (INR 1.01 billion) worth of EBs were sold during the 2nd phase. This is 50% lesser than the sale clocked during the first phase.

3) Once again, more EBs of Rs. 10 lakh (INR 1 million) denomination (138 nos.) were sold as compared with other denominations.

4) Only 7 EBs of Rs. 1,000 denomination were sold - 3 through the branch New Delhi and 2 each through the Kolkata and Chennai branches.

5) All EBs of Rs. 1 lakh (INR 100,000) denomination were sold through the Gandhinagar branch of SBI and nowhere else.

6) SBI's Kolkata branch sold the most number of EBs of Rs. 10 lakh denomination (100 nos.) while Gandhinagar was the only other branch to sell EBs of this denomination (38 nos.)

7) SBI's Mumbai branch sold more EBs of Rs. 1 crore (Rs. 10 million) denomination (51 nos.) than other branches. Kolkata branch sold (30 nos.), New Delhi branch sold 10 nos., Gandhinagar branch sold 9 nos. and Chennai branch sold 1 no.

8) From the reply that the CPIO sent me, it appears that no EBs were sold in the newly designated SBI branches in Chandigarh, Bengaluru, Bhopal, Jaipur Lucknow and Guwahati.

However, the same CPIO informed another RTI applicant - Mr. Rakesh Reddy, Dubbudu of Factly.in, that 57 EBs of various denominations ranging from Rs. 1 lakh to Rs. 1 crore were sold from the Bengaluru branch of SBI. That reply was sent more than 3 weeks before the reply I received against my RTI application. So which reply of the CPIO is correct and complete is anybody's guess. Hence the discrepancy between the two sets of figures.

III. Overall trend of the two phases:

1) Cumulatively, SBI is said to have sold 776 EBs worth Rs. 333.48 crores (INR 3.33 billion) during the two phases through 5 out of 11 notified branches.

2)SBI's Mumbai branch recorded the highest sale of EBs (both phases included) at a little more than Rs. 173 crores (INR 1.73 billion+) followed by the Kolkata branch- a little more than Rs. 70 crores (INR 700 million+), the New Delhi branch- a little more than Rs. 63 crores (INR 630 million+) and the Gandhinagar- a little more than Rs. 19 crores (INR 190 million+). Chennai's SBI branch sold the least- a little more than Rs. 18 crores (INR 180 million+)

3) The most number of EBs of the highest denomination Rs. 1 crore (INR 10 million) were sold through the Mumbai SBI branch (166 nos.) followed by New Delhi branch (62 nos.), Kolkata branch (40 nos.), Chennai branch (14 nos.) and Gandhinagar branch (9 nos.)

4) In terms of absolute numbers, EBs of Rs. 10 lakh denomination were sold the most, netting Rs. 45.80 crores (INR 458 million). However EBs of Rs. 1 crore denomination were sold to the tune of Rs. 291 crores (INR 2.9 billion) through multiple branches of the Bank.

5) Only 17 EBs of Rs. 1,000 denomination and 10 of Rs. 1,00,000 (INR 100,000) were sold during this period.

6) Even though the EB Scheme provides for issuance of bonds of Rs. 10,000 denomination, it appears that there were no buyers of EBs of this denomination.

The above data about the implementation of the EB scheme obtained from SBI under the RTI Act clearly indicates that it is serving the super-rich and somewhat less rich donors more than the rest of the citizenry.

SBI withholds the identity of EB buyers

1) Thanks to the SBI CPIO's wrongful interpretation of Section 7(9) of the RTI Act, the actual number of buyers of each denomination of the EBs is not known. Section 7(9) is a positive provision which enables a citizen to access information in the form in which he or she requires. This is subject to the caveats that by so doing the public authority must not end up disproportionately diverting its resources or harm the safety and preservation of records. In such cases the Central Information Commission and other State Information Commissions have consistently ruled that if providing copies from disparate records is not possible, inspection of the relevant files may be allowed. The CPIO has simply ignored this requirement and treated Section 7(9) as an exemption clause. According to Section 7(1) of the RTI Act a CPIO may reject an RTI application only for reasons specified in Sections 8 and 9 of the Act. So the CPIO's decision of rejection of Query #(ii) of my RTI application is patently erroneous.

2) As regards Queries # (iii), (iv) and (vi) which are for copies of official records generated during the EB sale and redemption process, such as the application form used by the buyer and the redemption slip filled up by the political party for claiming the funds presented by the donor have been rejected under Section 8(1)(e) of the RTI Act by the CPIO claiming "fiduciary" relationship. So the CPIO is treating both the buyer of EBs and the political parties as being in a "fiduciary relationship with SBI! This is in complete violation of the Master Circular issued by the Reserve Bank of India regarding the basis of customer confidentiality. Para #25 of the July 2015 Master Circular states as follows:

"25. Customer Confidentiality Obligations

The scope of the secrecy law in India has generally followed the common law principles based on implied contract. The bankers' obligation to maintain secrecy arises out of the contractual relationship between the banker and customer, and as such no information should be divulged to third parties except under circumstances which are well defined. The following exceptions to the said rule are normally accepted:

- Where disclosure is under compulsion of law

- Where there is duty to the public to disclose

- Where interest of bank requires disclosure and

- Where the disclosure is made with the express or implied consent of the customer."

So when SBI is in a contractual relationship with its customers, according to the RBI, its CPIO cannot claim the protection of "fiduciary" relationship as well. A fiduciary relationship is a trust-based relationship. This position has been clearly explained by the Supreme Court of India. More importantly, when the Hon'ble Finance Minister has repeatedly said that EB scheme is "engineered" to make political party funding more transparent, then, is there not a duty to the public to disclose details of buyers of EBs? As the CPIO seems to believe otherwise, it is necessary now to bring the duty of disclosure, "under compulsion of the law", namely through the procedures of the RTI Act. Readers may click the link: Electoral Bonds (New) on SBI's website Main Menu to find out the kinds of basic documents that are generated during the sale and redemption of EBs.

SBI refuses access to reports sent to GoI and RBI about EB sale and redemption

Even worse, is the SBI CPIO's claim that all reports sent to the Government of India and the RBI regarding the sale and redemption of EBs are also covered by "fiduciary' relationship. In December 2015, in the matter of Reserve Bank of India vs Jayantilal Mistry Ors., [(2016) 3SCC 525] (batch matter), the Hon'ble Supreme Court rejected RBI's claim that it stands in a "fiduciary" relationship with the Banks that it regulate. This ruling came in the context of information requests regarding non-performing assets (NPAS) and loan defaulters from public sector banks. The relevant paras from the judgement are reproduced below:

"58. In the instant case, the RBI does not place itself in a fiduciary relationship with the Financial institutions (though, in word it puts itself to be in that position) because, the reports of the inspections, statements of the bank, information related to the business obtained by the RBI are not under the pretext of confidence or trust. In this case neither the RBI nor the Banks act in the interest of each other. By attaching an additional “fiduciary” label to the statutory duty, the Regulatory authorities have intentionally or unintentionally created an in terrorem [in fear] effect....

59. RBI is a statutory body set up by the RBI Act as India’s Central Bank. It is a statutory regulatory authority to oversee the functioning of the banks and the country’s banking sector....

60. RBI is supposed to uphold public interest and not the interest of individual banks. RBI is clearly not in any fiduciary relationship with any bank. RBI has no legal duty to maximize the benefit of any public sector or private sector bank, and thus there is no relationship of ‘trust’ between them. RBI has a statutory duty to uphold the interest of the public at large, the depositors, the country’s economy and the banking sector. Thus, RBI ought to act with transparency and not hide information that might embarrass individual banks. It is duty bound to comply with the provisions of the RTI Act and disclose the information sought by the respondents herein."

62. The exemption contained in Section 8(1)(e) applies to exceptional cases and only with regard to certain pieces of information, for which disclosure is unwarranted or undesirable. If information is available with a regulatory agency not in fiduciary relationship, there is no reason to withhold the disclosure of the same. However, where information is required by mandate of law to be provided to an authority, it cannot be said that such information is being provided in a fiduciary relationship. As in the instant case, the Financial institutions have an obligation to provide all the information to the RBI and such an information shared under an obligation/ duty cannot be considered to come under the purview of being shared in fiduciary relationship."

It is only obvious that the same ratio will apply to SBI in its relationship with the RBI and the Government of India. There is no 'fiduciary' relationship between them. Clearly, the CPIO is either unaware or has chosen to ignore the Supreme Court's ruling in Jayantilal Mistry.

The SBI's CPIO has also invoked Section 8(1)(j) of the RTI Act, namely the protection available for personal information against unwarranted invasion of the privacy of an individual, to reject access to information about both buyers of EBs and political parties which redeemed them.

While in my humble opinion, this is also an incorrect decision, if the reply is based on factual data, then it implies that all EBs were bought only by individuals and not corporations, firms, associations or trusts. However, it is difficult to reasonably conjecture that none of these private entities used EBs to make donations to political parties. Prior to the launch of the EB scheme, corporations and Electoral Trusts made large-sized donations to political parties. This information is available on the website of the Election Commission of India (ECI) which the Association for Democratic Reforms analyses and reports upon from time to time. So the CPIO's reply in this context may also be challenged.

As for Query #(v) of my RTI application, the SBI's CPIO stated that the Bank sourced data about votes polled by political parties from the ECI's website to determine whether they received at least 1% of the vote in order to be eligible to receive donations through EBs. I have no quarrel with that reply.

All in all, this case will get more interesting as the CPIO is not on solid ground for rejecting six of the eight RTI queries. I hope to challenge the CPIO's decision through the appeals process, but it is important to point out that the EB mechanism in actual practice is proving to be opaque contrary to the repeated claims of the Government of India.

Electoral Bonds Scheme explained in brief

The EB Scheme allows any person (including HUF), company, firm, charitable trust or unincorporated body of individuals to buy EBs from the designated branches of SBI during each window of sale that the government announces from time to time. EBs are in the nature of promissory notes and carry no rate of interest. The identity of the buyer is not recorded on the EB. So the political party will have no formal mechanism to know who is the actual donor through EB. A buyer could send the EBs through his/her chauffeur to be delivered at the office of a political party. EBs have a validity of 15 days only. There is no limit on how many or how much worth of EBs any person can buy. Recipient political parties have to redeem the EBs within this period using an SBI account. The value of EBs will not be credited to any other bank where the political party may have an account. If they miss the 15-day deadline neither the buyer nor the recipient political party gets the money back. Instead it will be deposited in the Prime Minister Relief Fund (see 3rd attachment for the Gazette notification of the EB scheme).

Through the Finance Act, 2017, the Government of India made the following changes to the statutory scheme of political party funding :

1) Cash donations to political parties must not be more than Rs. 2,000/- from one donor;

2) Donations of any amount may be made to political parties through cheques, bank drafts or electronic transfers by individuals and companies, associations, trusts etc.;

3) The RBI Act, 1934 was amended to provide statutory recognition of electoral bonds

4) The Income Tax Act, 1961 was amended to relieve political parties from the obligation of reporting details of donations received through EBs to the tax authorities in order to continue to avail IT exemption;

5) The Representation of the People Act, 1951 was amended to relieve political parties from the obligation of maintaining the identity of donors who use EBs and disclosing the same to the Election Commission of India; and

6) The Companies Act, 2013 was amended to completely remove the cap on registered companies for making donations to political parties. Earlier, they could donate not mote than 7.5% of their net profit during the three preceding years and publicly disclose the same in their profit and loss at the end of the year. Thanks to the 2017 amendments which became operational in April 2018, a company can in theory donate its entire share capital to political parties soon after formation and then wind up. Limits on both time and amounts have been removed. Further, there is no duty place don companies to reveal the name of the political party to which they donate any amount of money, (let alone through EBs) in their profit and loss account).

So much for increased transparency in political party funding. Like I remarked a day after the EB idea was announced through the annual budget in February 2017, this is a backward leap to the era of secrecy.

I request readers to read the text of these amended laws along with the Finance Act, 2017 in order to appreciate the changes made in the mechanism of political party funding in India. An investigative report published by The Quint revealed that the EBs carry a hidden serial number which is visible only under ultraviolet light. SBI is said to have issued an explanation that it is only a security feature and cannot be used to trace the identity of a buyer.

Tax liability of donors to political parties through EBs:

1) Under Section 80GGC of the Income Tax Act, 1961 any income tax assessee (individual, firm, association, trust or unincorporated body of individuals) may donate any amount of funds to a registered political party or an electoral trust (which was set up specifically for the purpose of channelising funds to political parties from the public) and claim 100% tax exemption on that amount. The only requirement is that such donations must not be made in cash. So, as of now any individual who is permitted to donate up to Rs. 2,000 in cash, to any political party is not eligible for any deduction on his or her tax liability. Only large donations are entitled to tax exemption if made in cash-less mode. In my humble view, this is rank discrimination against small donors who are private citizens. If challenged in Court, this provision is likely to fail the test of the fundamental "right to equality before the law and equal protection of the law" guaranteed under Article 14 of the Constitution,

2) Under Section 80GGB of the Income Tax Act, 1961, any company/corporation, registered in India may donate any amount of funds to a registered political party or an electoral trust and claim 100% tax exemption on that amount. The only requirement is that such donations must not be made in cash.

3) Thanks to the manner in which the Income Tax Act is structured, foreign companies, making donations to political parties (after the amendments made to the Foreign Contribution Regulation Act, 2010 in 2016 and more recently in 2018) can claim 100% tax exemption in the manner of assessees under Section 80GGC of the Income Tax Act,1961. There is no separate provision in the Act that governs foreign companies that donate to political parties.

To the best of my knowledge, the 2017 amendments to the Income Tax Act do not state anything about how a donor may prove that he/she/it purchased EBs and donated them to a political party and claim tax exemption under these Sections before the IT authorities. If an IT inquiry is launched against an assessee, then apart from the SBI which sells the EBs, the IT Dept. will have access to EB buyer information. So how will the IT Assessing Officer find out whether the assessee's claim of buying EBs from SBI and donating them to a political party(ies) is true? Perhaps the invisible serial number on every EB that The Quint exposed in April this year might hold the clue.

In all fairness, the Electoral Bonds Scheme is another example of the "deep State" which seeks to deeply monitor citizens and bodies in an opaque manner.

CHRI trail of enquiry: 1st attachment | 2nd attachment | 3rd attachment

Press : Times of India | Business Television India | Business Standard | IndiaToday | NDTV.com | News18.com | Financial Express | News Central 24x7 | BloombergQuint | DNA | Business World | First Post | Release Soon | Deccan Herald | Money Control | Udayavani | Youtube Ariane Sobers